We’re already way past wondering how AI will shake up the financial industry – it’s happening as we speak. As CTO at global fintech firm Verto, I can see how AI is going to impact every aspect of our ops, from fraud detection and risk management to software engineering and personalised financial services.

Yes, there will be differences in how you use AI depending on the goals of your business. But there’s no doubt we’re going to see increasing focus on a range of AI tools within the next few years – and a host of new challenges as well.

Here’s what all of this is likely to mean for our industry.

Fraud detection is going to get a big boost

One of AI’s most promising applications lies in fraud detection. By using real-time transaction monitoring backed up by AI and machine learning, we can spot suspicious patterns and potential fraud with real accuracy. The results speak for themselves – after employing AI-powered fraud detection, Danske Bank reported a 60% reduction in false positives and a 50% improvement in fraud detection rates.

Added to this is AI’s potential to revolutionise software engineering within the industry through AI-powered code generation and automated testing. This will streamline development, accelerate time-to-market, and raise the overall quality of financial products. And then there’s personalisation…

Personalisation is key to growth

Tailored products and services might already be important in our industry, but they’re set to get a lot bigger thanks to AI. Through machine-learning algorithms and vast datasets, fintechs can bring personalisation up to a new level, enhancing customer engagement and loyalty, and ultimately boosting margins.

There’s also likely to be a large uptake of chatbots across the industry that will be able to quickly and accurately respond to customers, based on highly personalised data.

But AI will bring challenges

While AI holds immense potential, there’s no doubt we need to be cautious.

At Verto for instance, we’re navigating the complexities of cross-border payments, emerging markets, and international payments, and that means a complex regulatory landscape that can – and does – stifle innovation. We’re also fully aware of ethical considerations, data privacy, and potential biases in AI systems; all viable concerns.

So, we need regulators to strike a delicate balance between encouraging innovation and implementing safeguards to address these issues. Regulatory sandboxes can offer a middle ground, allowing fintechs to test and refine innovations in a controlled setting.

The future of AI for the financial industry

You might still be wondering if all this talk of AI is just hype.

My answer is a definitive no. Through its impact on the day-to-day operations of businesses, AI is already reshaping industries, including finance – and it will continue to do so. Yes, emerging technologies such as quantum and neuromorphic computing, as well as advanced robotics, might take some of the hype away from AI in time, but let’s look at the here and now: AI is already proving crucial.

In the financial industry, its impact will be seen most closely in areas such as fraud detection, personalisation, software engineering, and risk assessment. And that’s not ignoring the fact there will be challenges to overcome in due course – around regulations, data privacy, and even the sustainability of AI.

But by embracing this technology responsibly and paving the way for a more efficient, personalised, and secure financial landscape, we can unlock AI’s full potential and drive innovation within the sector. And for the financial industry, surely that has to represent a net benefit?

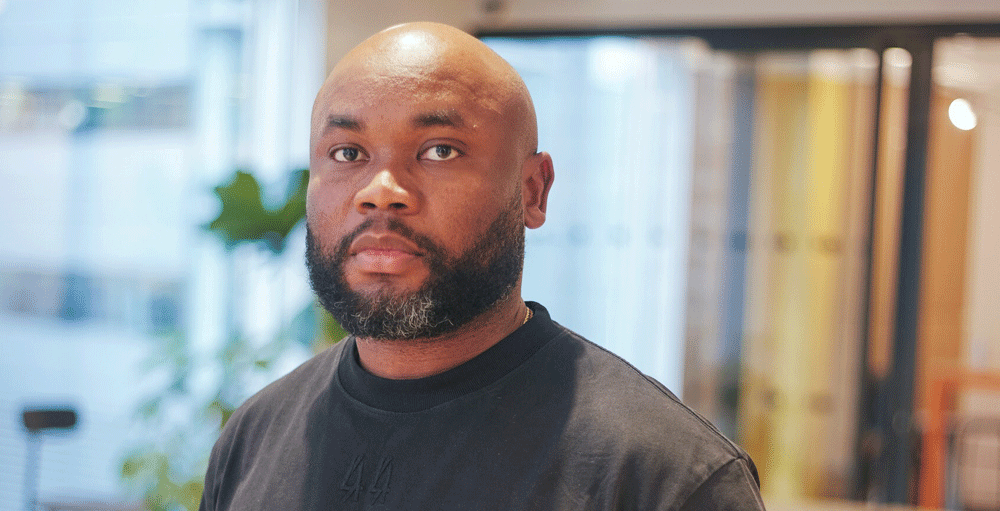

By Anthony Oduu, Co-founder and Chief Technology and Product Officer, Verto